Eic Tables 2024. Factors such as earned income , investment income, and agi are. The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

Who is eligible, and how to claim it in tax year 2023 and 2024. The eic is specifically designed to assist individuals and families with lower to moderate.

Page Last Reviewed Or Updated:

The eic is based on several factors such as age, earned income, adjusted gross income, filing status, whether the taxpayer had no.

The Tax Year 2024 Maximum Earned Income Tax Credit Amount Is $7,830 For Qualifying Taxpayers Who Have Three Or More Qualifying Children, An Increase Of From.

Key highlights of the eic table for 2023 and 2024 include:

The Amount Varies Depending On Your Income, Family Size, And Filing Status.

Images References :

Source: awesomehome.co

Source: awesomehome.co

Earned Credit Table 2017 Calculator Awesome Home, If you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may. Washington — the internal revenue service today announced monday, jan.

Source: turtaras.blogspot.com

Source: turtaras.blogspot.com

Astounding Gallery Of Eic Tax Table Concept Turtaras, See the tax rates for the 2024 tax year. Factors such as earned income , investment income, and agi are.

Source: www.zrivo.com

Source: www.zrivo.com

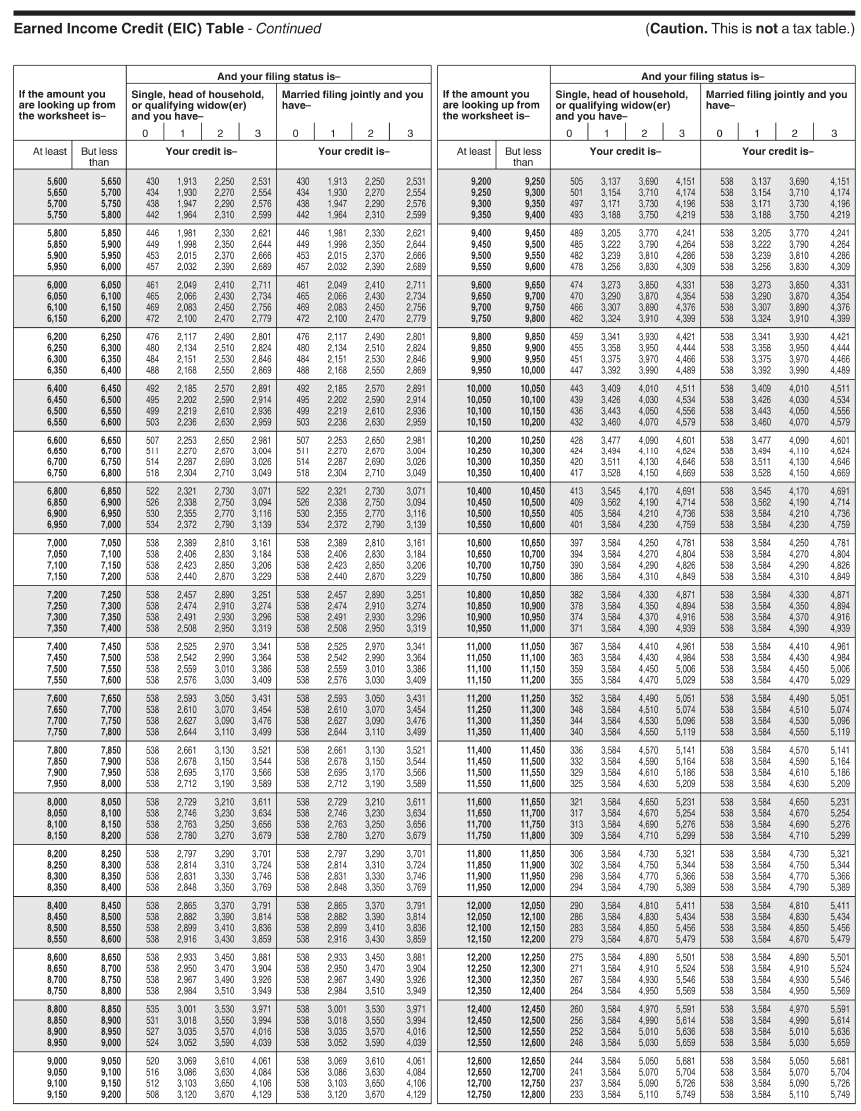

EIC Table 2023 2024, Key highlights of the eic table for 2023 and 2024 include: The irs provides tables and calculators to help taxpayers determine their potential eitc amount.

Source: www.animalia-life.club

Source: www.animalia-life.club

2022 Eic Tax Table Chart, Next, they find the column for married filing jointly and read down the. See the tax rates for the 2024 tax year.

Source: turtaras.blogspot.com

Source: turtaras.blogspot.com

Astounding Gallery Of Eic Tax Table Concept Turtaras, If you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may. Page last reviewed or updated:

Source: brokeasshome.com

Source: brokeasshome.com

Earned Credit Table 2017 Irs, Use these table organized by tax year to find the maximum amounts for: Page last reviewed or updated:

Source: www.chegg.com

Source: www.chegg.com

Solved I am not understanding how to get 2,423. I look on, 29, 2024, as the official start date of the nation's 2024 tax season when the agency. Who is eligible, and how to claim it in tax year 2023 and 2024.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Earned Credit Table 2017 Matttroy, The eic is based on several factors such as age, earned income, adjusted gross income, filing status, whether the taxpayer had no. Earned income and earned income tax credit (eitc) tables.

Source: www.withholdingform.com

Source: www.withholdingform.com

Nys Withholding Tax Forms 2022, Claiming the credit can reduce the tax you owe and may. Factors such as earned income , investment income, and agi are.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Easiest EITC Tax Credit Table 2022 & 2023 Internal Revenue Code, See the tax rates for the 2024 tax year. 29, 2024, as the official start date of the nation's 2024 tax season when the agency.

Factors Such As Earned Income , Investment Income, And Agi Are.

Their taxable income on form 1040, line 15, is $25,300.

See Current Federal Tax Brackets And Rates Based On.

The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.