Georgia Retirement Income Exclusion 2025. Georgia senators gave final passage to bills cutting state personal and corporate income taxes on wednesday, march 20, 2025. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently disabled.

Beginning january 1, 2022, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded for taxpayers with more than $17,500 of earned income in georgia. Stop irs and state collection actions.

Below Are The Requirements For The Ga Retirement/Disability Income Exclusion:

Georgia does not tax social security retirement benefits and provides a maximum deduction of $65,000 per person on all types of retirement income for anyone 65 or.

Stop Irs And State Collection Actions.

This exclusion allows a retiree who is 65 year or older to shield from state income taxes up to $65,000 in pension or investment income a year if single, $130,00 a year if married.

Georgia’s Retirement Income Exclusion Allows Qualified Taxpayers To Exclude Certain Forms Of Income From State Taxation.

Images References :

Source: retiregenz.com

Source: retiregenz.com

How Much Is The Retirement Exclusion? Retire Gen Z, Stop irs and state collection actions. Georgia offers a tax exclusion on up to $35,000 of retirement income earned by people 62 to 64, or up to $65,000 earned by those 65 and older.

Source: retiregenz.com

Source: retiregenz.com

How Much Is The Retirement Exclusion? Retire Gen Z, Beginning january 1, 2022, $17,500 of military retirement income can be excluded for taxpayers under 62 years of age and an additional $17,500 can be excluded for taxpayers with more than $17,500 of earned income in georgia. Below are the requirements for the ga retirement/disability income exclusion:

Source: elm3cpatax.com

Source: elm3cpatax.com

Understanding Retirement Exclusion Elm3, The rate will reduce each year until the flat rate reaches 4.99%. In 1981, georgia enacted an income tax exclusion for retirement income received by taxpayers aged 62 years and over.

Source: www.youtube.com

Source: www.youtube.com

How Taxes Retirees YouTube, Georgia offers a tax exclusion on up to $35,000 of retirement income earned by people 62 to 64, or up to $65,000 earned by those 65 and older. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently disabled.

Source: retiregenz.com

Source: retiregenz.com

How Much Is The Retirement Exclusion? Retire Gen Z, In 1981, georgia enacted an income tax exclusion for retirement income received by taxpayers aged 62 years and over. This exclusion allows a retiree who is 65 year or older to shield from state income taxes up to $65,000 in pension or investment income a year if single, $130,00 a year if married.

Source: www.retireguide.com

Source: www.retireguide.com

The 5 Best and Worst States to Retire in 2023, For taxpayers 65 or older, the retirement. The state does not tax social security benefits, withdrawals from pensions and retirement accounts are only partially taxed, and anyone over 62 or who are permanently disabled.

Source: elm3financial.com

Source: elm3financial.com

Understanding Retirement Exclusion Tax Accountant, The exclusion is available for the. In 1981, georgia enacted an income tax exclusion for retirement income received by taxpayers aged 62 years and over.

Source: elm3financial.com

Source: elm3financial.com

Understanding Retirement Exclusion Tax Accountant, The exclusion limit of $4,000 of earned income will also remain for all taxpayers 62 and older. Georgia senators gave final passage to bills cutting state personal and corporate income taxes on wednesday, march 20, 2025.

Source: www.annuity.org

Source: www.annuity.org

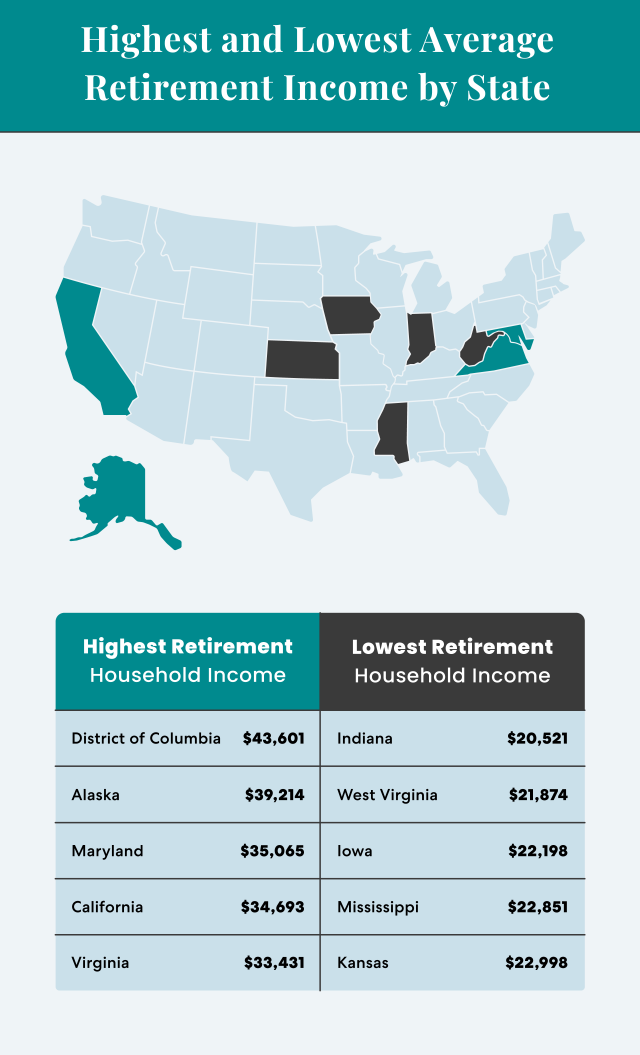

Average Retirement Where Do You Stand?, In 2022, georgia increased the amount. The exclusion is available for the.

Source: studylibmann88.z1.web.core.windows.net

Source: studylibmann88.z1.web.core.windows.net

Retirement Exclusion Worksheet, This bill replaced the graduated personal income tax with a flat rate of 5.49% effective january 1, 2025. Georgia does not tax social security retirement benefits and provides a maximum deduction of $65,000 per person on all types of retirement income for anyone 65 or.

(If You’re Married, You And Your.

The exclusion limit of $4,000 of earned income will also remain for all taxpayers 62 and older.

The Exclusion Is Available For The.

For taxable years beginning on or after january 1, 2012, retirement income from any source not to exceed an exclusion amount of $35,000.00 for each taxpayer meeting the.