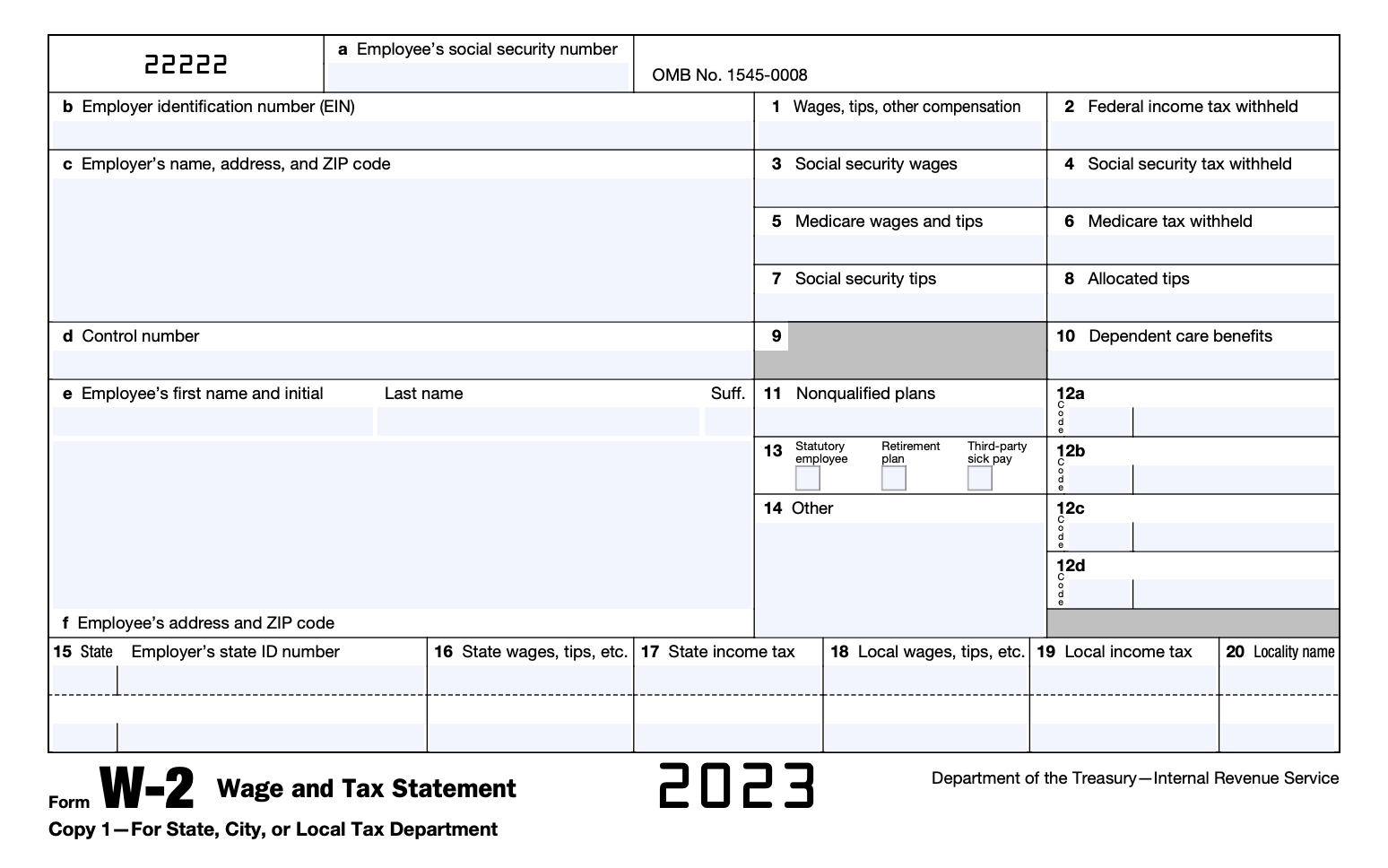

W-2 Form For Employees To Fill Out 2024. To use an online w2 finder, these steps should be taken: A w2 form, also known as a wage and tax statement, is sent to an employee who has worked for an employer during the tax year.

To complete this form, you’ll need your new employee’s social security. If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

To Complete This Form, You’ll Need Your New Employee’s Social Security.

Any employee you've paid within the previous tax year, between january 1 and december 31.

First Of All, Open The Current Version Of The Form.

File the form with the ssa and.

W-2 Form For Employees To Fill Out 2024 Images References :

Source: www.zrivo.com

Source: www.zrivo.com

W2 Form 2023 2024, To use an online w2 finder, these steps should be taken: Any employee you've paid within the previous tax year, between january 1 and december 31.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

How To Fill Out a W2 Form & Everything Else Employers Need To Know, After you submit your return, you will receive an email from customer_service@freefilefillableforms.com, that the irs accepted your federal return. Follow the directions and input your details into the w2 locater service.

Source: www.forbes.com

Source: www.forbes.com

Understanding Your Tax Forms The W2, Enter the amount of federal income taxes that have been withheld from the employee’s paychecks throughout the year. After you submit your return, you will receive an email from customer_service@freefilefillableforms.com, that the irs accepted your federal return.

Source: tedqkirbee.pages.dev

Source: tedqkirbee.pages.dev

Nc W2 Form 2024 Estel Janella, Follow the directions and input your details into the w2 locater service. Any employee you've paid within the previous tax year, between january 1 and december 31.

Source: www.halfpricesoft.com

Source: www.halfpricesoft.com

How to Print W2 Forms on White Paper, For the 2023 tax year, if tax deposits have been made, you’ll have until february 12, 2024, to file. First of all, open the current version of the form.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

How to Fill Out Form W2 Detailed Guide for Employers, To use an online w2 finder, these steps should be taken: Any employee you've paid within the previous tax year, between january 1 and december 31.

Source: www.viralcovert.com

Source: www.viralcovert.com

W2 Forms For Employees To Fill Out Form Resume Examples qlkmd9ROaj, File the form with the ssa and. Enter the amount of federal income taxes that have been withheld from the employee’s paychecks throughout the year.

Source: gennabgiovanna.pages.dev

Source: gennabgiovanna.pages.dev

W2 Form 2024 Pdf California Candy Ronnie, For the 2023 tax year, if tax deposits have been made, you’ll have until february 12, 2024, to file. To complete this form, you’ll need your new employee’s social security.

Source: www.halfpricesoft.com

Source: www.halfpricesoft.com

Sample W2 Tax Forms, Follow the directions and input your details into the w2 locater service. If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable W2 Forms, Any employee you've paid within the previous tax year, between january 1 and december 31. If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

After Filling Out All The Required Details, The W2.

Follow the directions and input your details into the w2 locater service.

For The 2023 Tax Year, If Tax Deposits Have Been Made, You’ll Have Until February 12, 2024, To File.

To complete this form, you’ll need your new employee’s social security.